Executive summary

WhatsApp Business API is the unparalleled bridge between businesses and their vast global clientele. If leveraging WhatsApp business API for your business has piqued your interest yet left you with questions and curiosities, this guide will help you. This comprehensive guide sheds light on the ins and outs of WhatsApp Business API, from its foundational understanding to creating an account, managing contacts, and optimizing message delivery in line with best practices.

In June 2023, 2.78 billion individuals across the globe found themselves tapping away on WhatsApp. That’s an impressive 12% jump from the previous year. Yet, what’s more intriguing than its soaring user base is how WhatsApp has redefined its purpose.

WhatsApp, for many, has always been that trusty app to share a joke, coordinate plans, or exchange pictures with loved ones. But imagine harnessing this massive daily engagement for your business. The notion isn’t as futuristic as it sounds. With businesses of all sizes jumping aboard the WhatsApp train, it’s crystal clear: there’s more to this app than just emojis and video calls. And the crown jewel in this transformative journey? The WhatsApp Business API.

If you’ve toyed with the idea of integrating WhatsApp into your business communications or if the term ‘conversational marketing‘ rings a bell, you’re on the right track. With platforms like Yellow.ai making the transition smoother, reaching out to customers on their favorite messaging app might be your next best business move.

Related must read:

- WhatsApp chatbot – How to create AI WhatsApp bot?

- WhatsApp ads: A comprehensive guide for maximize click-to-chat

- WhatsApp session messages, their limitations and overcoming them

- Auto-reply on WhatsApp – Best practices and benefits

- 11 WhatsApp notification message templates for every business

What is WhatsApp business API?

The WhatsApp Business API emerges as a standout player when navigating the vast landscape of business communication tools. At its core, it’s a digital bridge designed by Meta (formerly Facebook) in 2018. It connects businesses to the vast world of WhatsApp users, enabling a seamless exchange of messages and interactions. But it’s not just a simple message relay system; it’s an innovative solution for medium to large businesses looking to engage with their audience at scale.

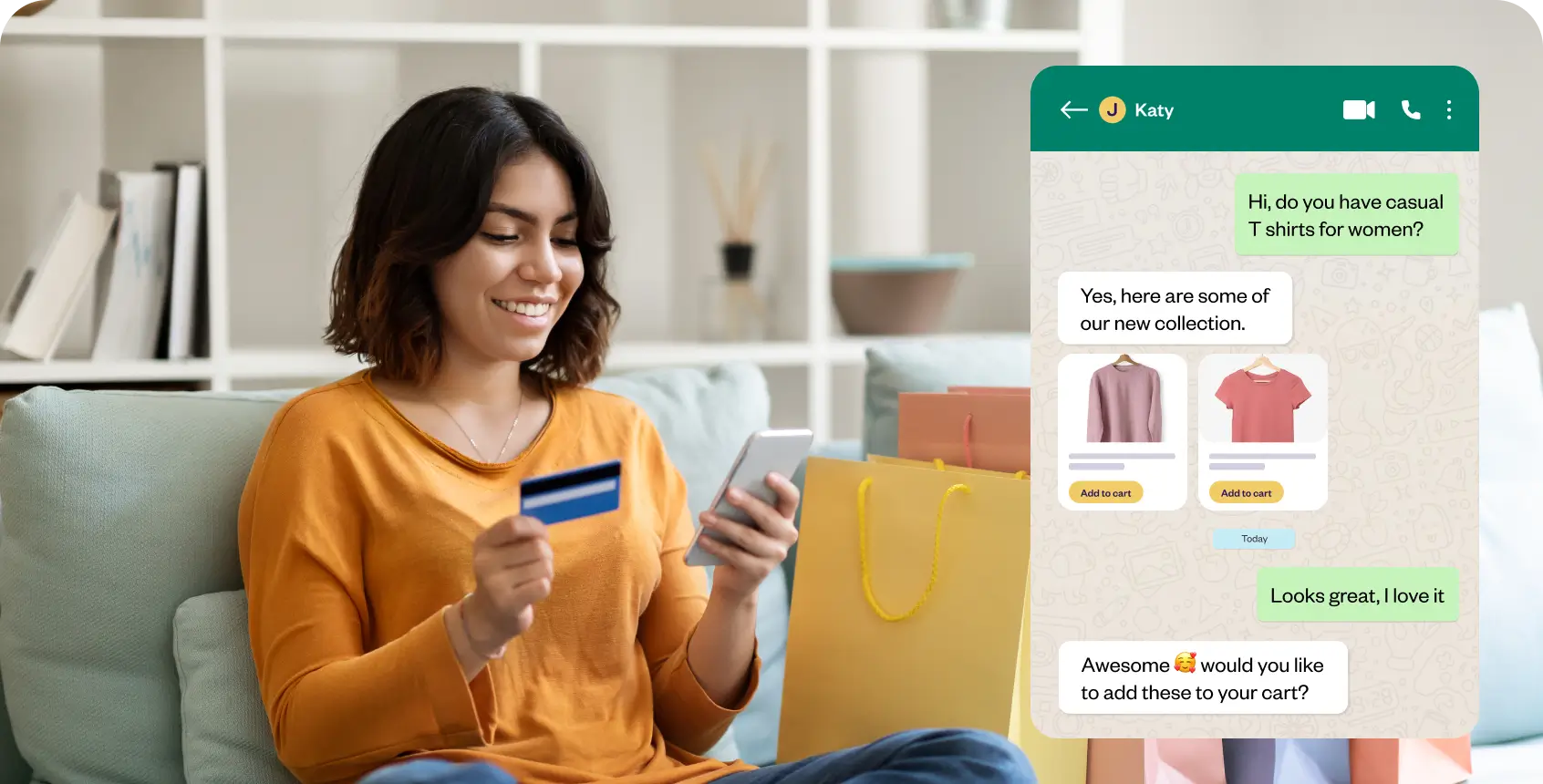

So, what exactly is it? The WhatsApp Business API acts as a backend mechanism that allows businesses to manage and automate their conversations on WhatsApp. Instead of a tangible app or interface that one might use on a personal device, the API is integrated into other messaging platforms or systems businesses already use. The objective? To handle multiple conversations, craft personalized dialogues, and facilitate automated responses—all within the trusted space of WhatsApp.

Although one might consider setting up the API through Meta, platforms like Yellow.ai, have made the process more accessible and intuitive. With their tools and dashboards tailored for businesses, Yellow.ai simplifies the WhatsApp API experience. It’s less about getting lost in technicalities and more about harnessing the real power of the platform to foster genuine connections with customers.

You might hear some folks referring to it as the “WhatsApp Business Platform” from 2023 onward, courtesy of a rebranding exercise by Meta. But regardless of the name, its core purpose remains—to revolutionize business communication in today’s digital age.

4 Reasons for shifting to WhatsApp business

Building on the growing momentum of conversational marketing, integrating the WhatsApp Business API into your business model might seem like the next logical step. But beyond the technicalities and the sheer vastness of WhatsApp’s user base, why should businesses consider this transition? Let’s dive into the compelling reasons:

1. Unmatched open rates

Email marketing has its merits, but WhatsApp takes the crown to ensure your message is seen. With an astonishing 98% message open rate, WhatsApp dwarfs the open rates of emails, which typically hover between 15-25%. Almost every message you send on WhatsApp gets noticed, and you aren’t lost in a crowded inbox. (Source)

2. Tailored customer interactions

The essence of marketing is understanding and connecting with your audience. WhatsApp Business facilitates personalized customer experiences. By understanding your audience’s preferences and behaviors, businesses can craft messages that resonate more deeply and drive meaningful engagement.

3. The vastness of reach

We’ve touched on it before, but it’s worth reiterating – 2.78 billion people are active on WhatsApp. That’s billions of potential customers, partners, and stakeholders at your fingertips. Leveraging WhatsApp Business ensures you cast a wide net in your marketing and communication endeavors.

4. Cost-effective global outreach

In a digital era where marketing costs can skyrocket, WhatsApp provides a breath of fresh air. Reaching out to a global audience doesn’t require a hefty advertising budget. With merely a smartphone and a stable internet connection, businesses can initiate conversations, foster relationships, and drive conversions without burning a hole in their pockets.

Embracing WhatsApp Business API is not just about jumping on a trend but strategically positioning your business to connect, engage, and thrive in a digitally-driven marketplace.

Who can use the WhatsApp business API?

As we traverse the digital pathways of effective business communication, it’s natural to ponder if the WhatsApp Business API aligns with your company’s needs and constraints. Before commencing the journey, it’s essential to understand if your business aligns with the stipulations set out by WhatsApp.

Here’s a streamlined guide to help you decipher whether the WhatsApp Business API is a good fit:

1. Business size

Small businesses, typically those with a close-knit team of up to 5, might find solace in the cozy confines of the free WhatsApp Business app. But, as your clientele grows and their incessant pings become the soundtrack of your operations, the WhatsApp Business API beckons. It’s the go-to choice for medium to large enterprises, effortlessly balancing multiple conversations.

2. Communication volume

If your business messages are more like a steady stream than occasional raindrops, it’s a sign to look towards the WhatsApp Business API. It not only allows you to send messages en masse, but with chatbots in the mix, automated replies become a breeze.

Picture this: A customer queries about an upcoming sale, and voila! Your chatbot, armed with predefined responses, provides the details instantaneously.

3. Industry type

While sectors such as telecommunications, real estate, and travel can freely harness the power of the WhatsApp Business API, some industries face a red light. Due to WhatsApp’s robust commerce policy, businesses involved in adult entertainment, gambling, or arms sales are kept at arm’s length. So, before jumping in, ensure your industry gets the green signal.

4. Compliance and messaging templates

In industries where regulations cast a long shadow, like healthcare or finance, messaging can’t be a shot in the dark. The WhatsApp Business API offers pre-defined templates that are in line with standards. Imagine you’re a financial consultant. Updating clients about their stock portfolio status with these templates is as smooth as swiping right on a chat.

How to get started with WhatsApp business API?

After deciphering whether WhatsApp Business API and your enterprise are a match made in digital heaven, the next chapter of our journey nudges us toward the actual setup. The process to access the WhatsApp Business API isn’t a mere click-and-start affair but rather a sequence of intentional steps. Let’s peruse this together, ensuring each step is clear, concise, and, most importantly, actionable.

Step 1. Apply for WhatsApp Business API

To jumpstart the process, lean on one of WhatsApp’s approved Business Solution Providers. These trusty partners are like your techy friends who help set up your new devices. Among them, Yellow.ai shines bright, ensuring your application journey is as breezy as a walk in the park.

Kick-off by ensuring you have a Facebook Business Manager ID. This ID should be adorned with a verified number and display name. If you’re wondering, “What’s a Business Manager ID?” don’t fret. Simply create a Facebook Business Manager page. Think of it as setting up a digital storefront:

- Swing by the Facebook Business Manager and hit ‘Register’ to set up your account.

- Navigate to ‘Business Settings’ and pick the ‘WhatsApp account’ option from the accounts section.

- Fill out the basics: name, time zone, currency preferences, payment methods, P.O. number, website URL, industry, use case, region of operation, company headquarters’ country, and your Facebook Business Manager ID.

- Oh, and don’t forget the verification number—they’ll ping you with a code on your business contact.

- Punch in that verification code, and give yourself a mini-celebration.

But we’re not done just yet. Next, you’d want to ensure your business name isn’t just a fancy moniker but a legit, verified entity.

Step 2. Provide basic information

So, imagine you’re at a mixer and introducing your business to a room full of potential partners. You’d want to share the basics, right? Similarly, feed some elementary information about your enterprise to set up your WhatsApp Business Account.

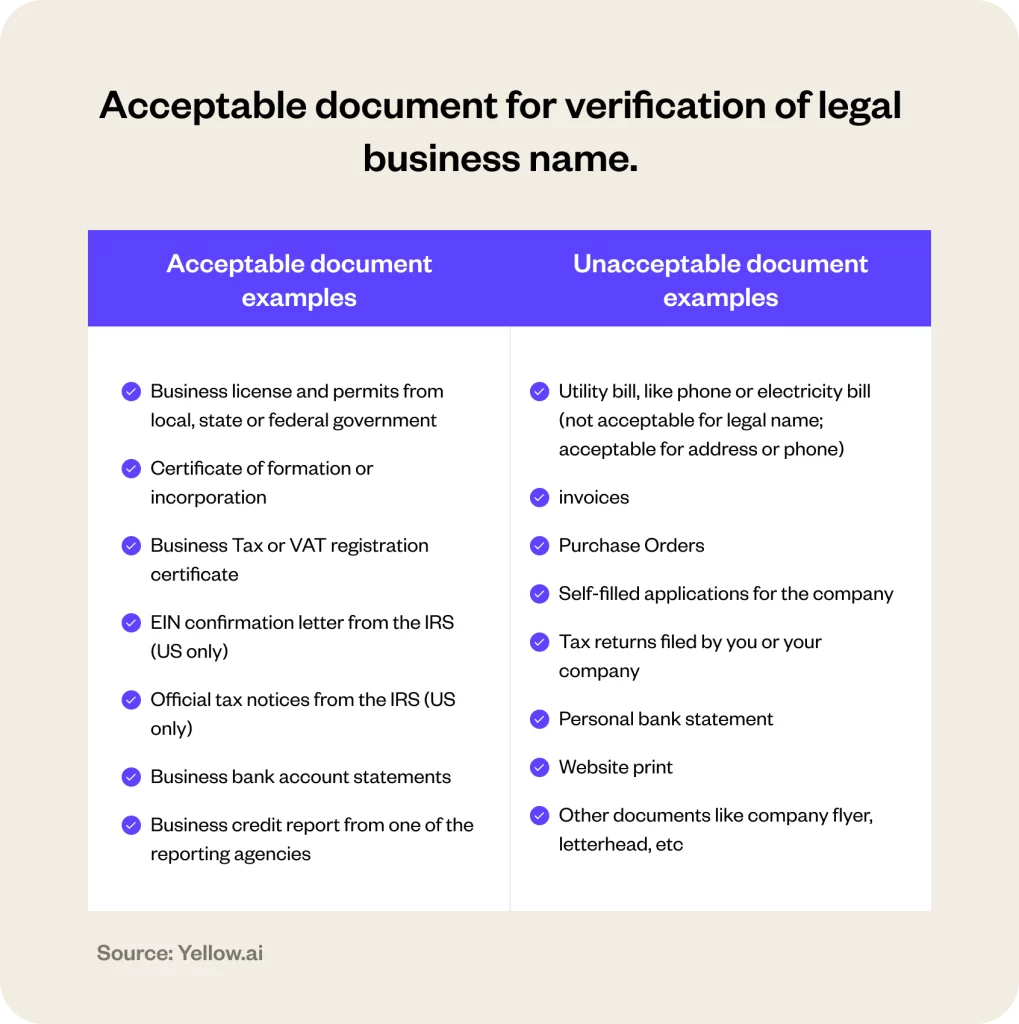

Here’s a brief list of documents you’d need:

- Incorporation Certificate or Articles

- A valid business license or registration document

- Government-issued business tax documents (nope, self-filed ones won’t make the cut)

- A recent business bank statement

- Utility bills showcasing the legal business name

If these are in a language not part of the Meta-supported list, just ensure they come with a certified English translation. You can check the supported languages for business verification from the Meta Business Help Centre page. And remember, a stamp from a translating agency is vital.

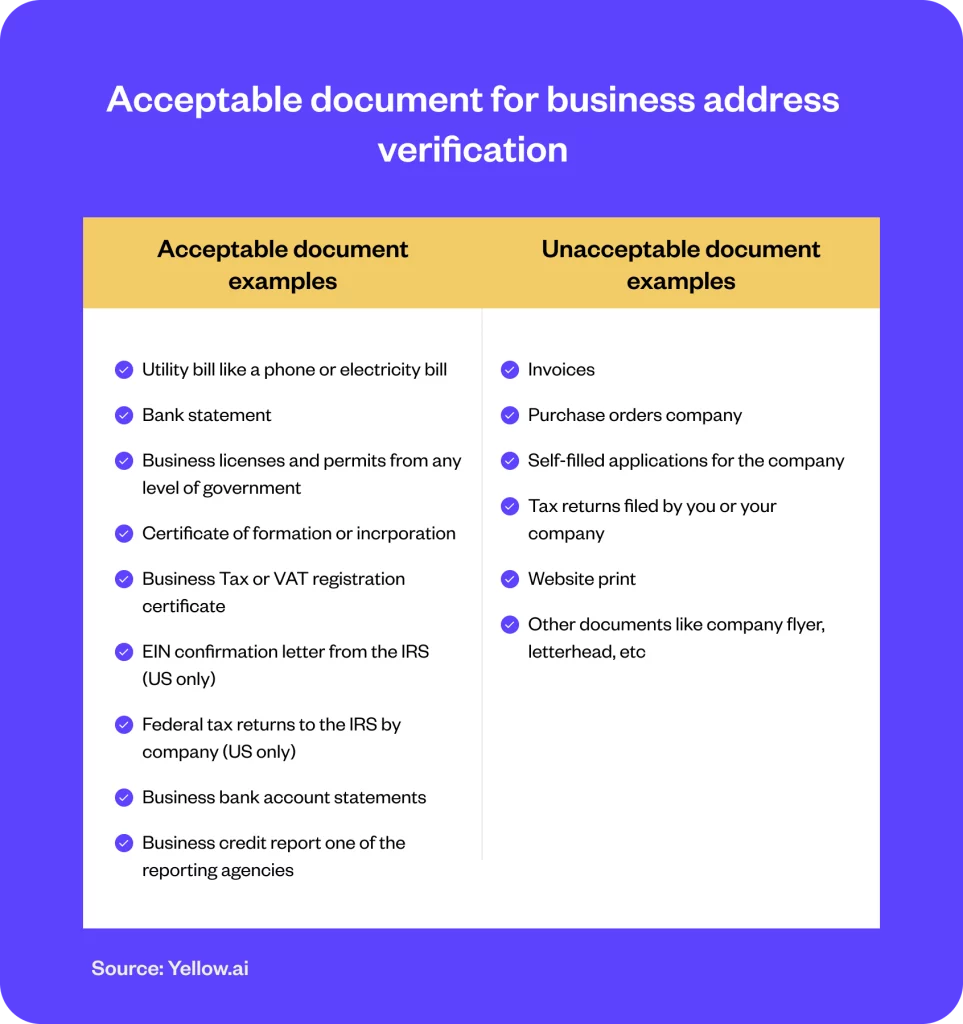

Acceptable documents for business address verification:

- Utility bill

- Bank statements or business bank account statements

- Business licenses

- Certification of formation or incorporation

- VAT registration or Business Tax certificate

- EIN Confirmation letter from IRS

- Federal Tax returns to the IRS

- Business credit report from one of the reporting agencies

A heads-up, though: Sometimes, Facebook might take its sweet time (around 2-3 weeks) to churn through these details.

Step 3. Activate phone number for WhatsApp Business account

With the foundation firmly in place, let’s breathe life into your WhatsApp Business Account by activating your chosen phone number. Whether it’s a number with you since day one or a fresh string of digits, the choice is yours. Upon the green light from Facebook, it’s time to finesse your WhatsApp profile.

Here’s where your business’s display name, category, description, and product listing step into the limelight. Each detail should reflect your brand, ensuring consistency and recognizability in every customer interaction. You can give these details to Yellow.ai, and we will finish setting up the API for you.

While it may seem like a flurry of steps and documents, remember: the goal isn’t just about creating a profile. It’s about building a bridge to over 2.78 billion potential conversations, each a pathway to a customer, partner, or opportunity.

And there we have it—a straightforward, no-frills guide to getting started with WhatsApp Business API.

WhatsApp API vs. WhatsApp business app

In the vast universe of WhatsApp, while the primary app caters to personal conversations, two luminous stars are dedicated to businesses—the Business App and the Business API (Platform). The duality is designed to be complementary rather than contradictory. Still, with their unique quirks, capabilities, and price tags, it’s essential to understand where each fits snugly in the business tapestry. Let’s explore and differentiate these two realms of WhatsApp’s business solutions.

Below, find a table that paints a clear and concise picture, helping you navigate the intricate dance between the two:

| Attributes | WhatsApp Business API | WhatsApp Business app |

|---|---|---|

| Suitable for | Medium to large businesses with a vast, growing clientele | Small and medium businesses with a modest clientele |

| Type of use | Mass messaging marketing and strategic customer service | Small-scale marketing and customer service |

| Type of communication | One-to-one and one-to-many messages | Only one-to-one messages |

| Pricing | Paid | Free |

| Integration with other software | CRM, e-commerce platforms | Not available |

| Device | Requires platforms like Yellow.ai for seamless operations | Works on app and browser |

| Business tools | • Business profile • Official green tick • Product catalog • Broadcast messages • Session messages • Automated/template messages (chatbots, transactional) • Initiate but not join group chats | • Business profile • Product catalog • Limited broadcast messages • Restricted automated messages • Initiate and join group chats |

| Users | Unlimited users and devices | 1 user, 2 devices max |

| Scope of use | Contacts imported from an opt-in list | Contacts from a phone with an active WhatsApp account |

| Clickable messages | Yes | No |

| Install chatbots | Yes | No |

At a glance, the table above offers insights that, like the North Star, guide businesses toward the path best aligned with their needs. And while both the WhatsApp Business App and API orbit the same purpose—to enrich business-client interactions—their distinct features ensure every venture, big or small, finds its sweet spot in the WhatsApp universe.

Top 10 benefits of using WhatsApp business API

As we propel through the space of modern business communications, WhatsApp Business API shines brightly, offering a constellation of benefits. From automated messages to secure interactions, it is a potent vehicle that propels your business toward stellar customer engagement and communication. Let’s explore the top 10 reasons why adopting WhatsApp Business API can illuminate your path to enriching customer interactions and broadening horizons.

1. Private and secure messaging

The fortress of WhatsApp API stands tall, safeguarding every byte of communication with end-to-end encryption and robust two-factor authentication (2FA). Keeping GDPR compliance in check ensures messages are only dispatched to those who’ve willingly opted in, securing businesses and their cherished customers under its protective wing.

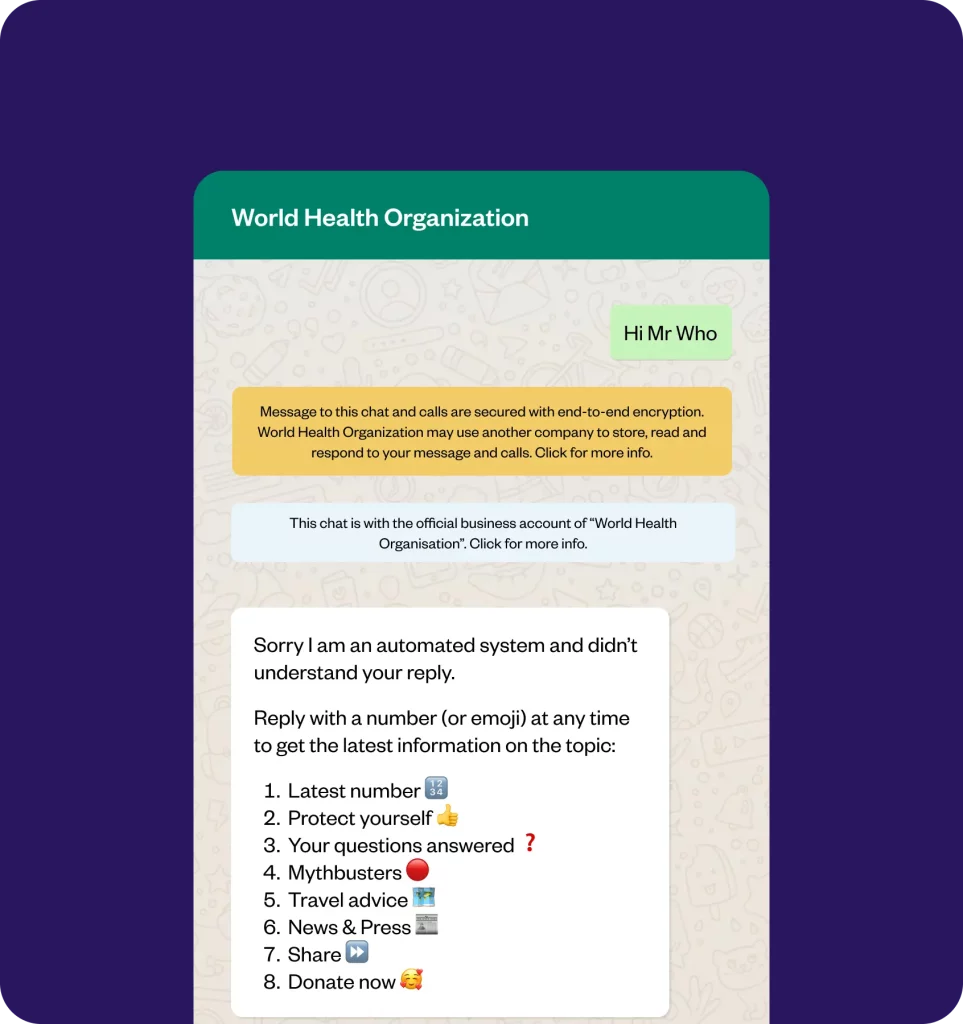

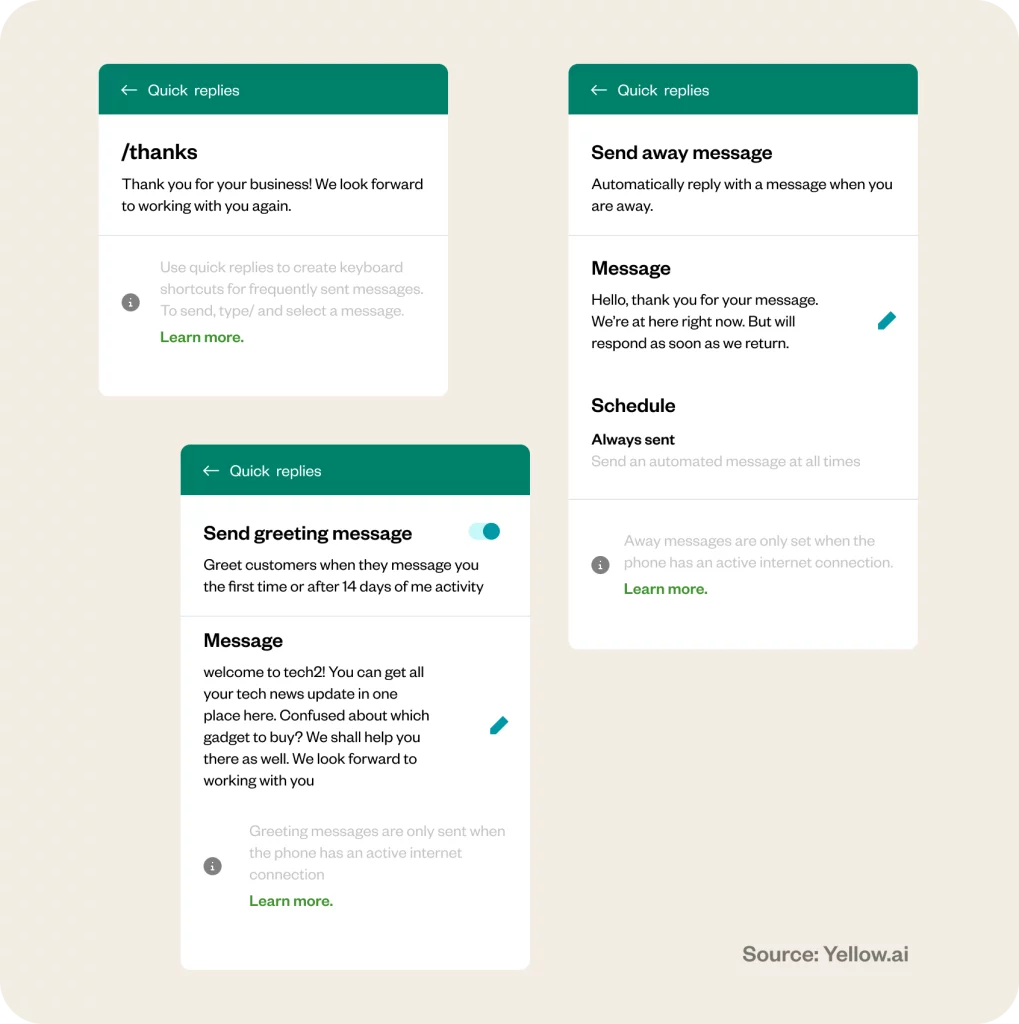

2. Automated responses

Seamless automated messages, from gentle reminders of appointments to joyful news of shipment updates, can echo through your customer interactions, keeping them informed and engaged with interactive and instant responses.

3. High reach and engagement

With over 2.78 billion users navigating through WhatsApp, it offers an unparalleled medium to transmit your messages, ensuring they are not just sent but also read and resonated with, connecting your brand to a universe of clients.

4. Personalization experiences

Tailor your messages with a sprinkle of personalized stardust – be it names, locations, or language preferences. The support for ten languages empowers your business to converse with customers in tones that feel like home.

5. Two-way messaging

Engage in genuine, two-way dialogues with your customers, transcending beyond mere transactional interactions and fostering relationships that blossom into loyalty and trust.

6. Interactive platform

Infuse life into your communications by embedding a variety of media – from videos to documents, ensuring every message paints a complete picture, narrating the tales of your products and services vividly.

7. Create superior brand connections

The WhatsApp Business API carves a space where your brand can sparkle with authenticity and uniqueness, fostering connections that resonate and are recognized, owing to the validated business accounts.

8. Answer FAQs

Forge chatbots that sail smoothly through the sea of common customer queries, ensuring every question finds its answer and every customer finds satisfaction in swift and accurate responses.

9. Seamless integration

Integrate with CRMs and e-commerce platforms, enabling a harmonious flow of automated notifications and ensuring every system in your business universe communicates seamlessly with the other.

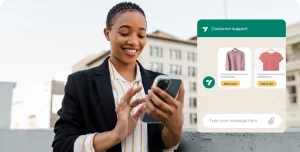

10. Actionable messages with clickable buttons

Embedding clickable CTA buttons turn your messages from mere information vessels to actionable communiques, driving engagements and conversions through a simple tap of a button.

Optimize user engagement with WhatsApp automation

What to do after setting up WhatsApp business API?

Navigating the next phase post-WhatsApp Business API setup? Here’s your roadmap to further enhance your business communication and engagement on WhatsApp:

Securing the ‘Green Tick’ on WhatsApp

That coveted green tick next to your business name is more than just a flashy symbol; it’s a beacon of trust and professionalism. Think of it as a stamp that tells your customers, “Hey, we’re legit!” While it might not offer additional features, it elevates your brand in the eyes of potential clients, even those who haven’t saved your number.

And guess what? Trusted partners like Yellow.ai are here to guide you through those nebulae, ensuring you achieve that green tick verification effortlessly.

Set up WhatsApp notifications

Want to keep your customers in the loop and engaged? Here’s how you do it:

1. Organize your contacts

Whether starting afresh or working with an existing list, ensure you have a well-segmented list of contacts ready to receive your WhatsApp notifications.

2. Design and validate your messages

Before you hit send, every message template needs a nod from WhatsApp. With Meta ensuring the quality and relevance of each template, businesses are safeguarded against spammy content. Once approved, your message blueprint is all set to communicate effectively with your audience.

Armed with your WhatsApp Business API and these subsequent steps, you’re primed to optimize customer engagement and drive meaningful conversations. It’s not just about setting the platform but also leveraging its potential for impactful business outcomes.

WhatsApp Business API pricing

Let’s get down to the nitty-gritty of WhatsApp Business API: the cost. Unlike the free WhatsApp Business App, the price tag can swing a bit based on what perks your chosen Business Solutions Provider offers. Book a demo if you want to know how Yellow.ai fits the equation. Our team’s always game to walk you through.

Here’s the lowdown on costs:

1. Conversation cash

Freebies alert! Your initial 1000 support chats every month? On the house. It means many small to medium-sized ventures might never see an additional charge. However, after crossing that threshold, WhatsApp charges for every new conversation. Head to Meta’s Rate Cards section for the most up-to-date pricing across various regions and currencies.

A new session is initiated after the 24-hour window of an active chat. Pricing nuances exist based on location, category, and who initiated the chat. In the U.S.? Expect about 1 cent for customer-started chats and 1 to 2 cents for those sparked by businesses.

And here’s a pro tip: You’re billed only when you reply, so there are no charges for letting those unwanted messages sit.

2. Two conversation types to know

- User-Initiated Conversations (UIC): These conversations kick off when a business responds to a user within the 24-hour window. Picture your standard customer support chats. In the U.S., these typically hover around 8 cents.

- Business Initiated Conversations (BIC): These take the stage when businesses reach beyond the standard 24-hour window. But, a templated approach is necessary for BICs. Whatsapp categorizes BIC into:

- Utility: Think essential, functional messages, costing roughly 2 cents in the U.S.

- Authentications & Marketing messages: Both generally run about 1 cent.

Leveraging WhatsApp business API

Let’s get real: the WhatsApp Business API isn’t just another digital tool—it’s the MVP of your business communication toolkit:

- Support team: Consider it the secret sauce, turning your support team from casual chatters to chat champions. It’s like having a coffee chat with your customers, but online. Cozy, direct, and authentic.

- Analytics: Dive deep, get curious and become best friends with your data. See what ticks with your customers and what doesn’t. Adjust, refine, and win at messaging.

- Sales & marketing team: Imagine having a mega speaker to share your brand stories. Broadcast those tantalizing offers and let the magic of engagement drive those numbers up.

The final thoughts on WhatsApp Business API

Venturing into the WhatsApp Business API realm is akin to trading in those old roller skates for a pair of turbocharged rollerblades. Speed up, keep it personal, and make every conversation count. And if you’re a medium to large business? It’s not just a plus; it’s a game-changer.

Are you thinking of riding with Yellow.ai for the WhatsApp Business API? Book a Demo. Our experts are all ears, ready to tailor the experience just for you.

Frequently asked questions (FAQs)

Our aim is to provide businesses with complete knowledge of WhatsApp API. We have received a list of FAQs from our prospective customers about WhatsApp API, and here are the answers to them.

Does WhatsApp Business provide an API?

Yes, WhatsApp Business offers an API designed to help businesses manage and automate their communications with customers on a larger scale.

How can I get WhatsApp API for Business?

To get the WhatsApp Business API, you need to engage with a Business Solution Provider (BSP) like Yellow.ai, or you can directly apply through Meta’s website, following their application process. However, engaging with a BSP like Yellow.ai simplifies the process and reduces the hassle. Moreover, you can also access additional features.

Can we use WhatsApp business API without BSP?

Yes, you can. You can directly obtain the WhatsApp Business API from Meta without the involvement of a third-party BSP (Business Solution Provider). It provides a pathway for businesses to integrate their communication structure with WhatsApp’s expansive user base.

Can I change my WhatsApp account number after using it?

You can change your WhatsApp account number and company display name after setup via the Facebook Business Manager, ensuring your business details remain accurate and up-to-date.

What are the charges for WhatsApp API?

The pricing for WhatsApp API can differ significantly based on the services and insights provided by various BSPs. For specifics on Yellow.ai’s pricing model, you can request a demo, and a sales representative will guide you through their pricing structure.

Does Yellow.ai provide any free trial for WhatsApp API?

Yes, Yellow.ai provides a free chatbot for WhatsApp for three months, but this offer is applicable to customers opting for an annual plan. While Yellow.ai won’t charge platform fees or additional costs during this period, businesses will still need to cover WhatsApp’s usage fees.

How many users can use WhatsApp Business API?

The WhatsApp Business API enables up to 5 concurrent users, allowing one user on the phone and four on linked devices, given that none of the linked devices are mobile.

What is the WhatsApp Business API messaging limit?

WhatsApp Business API imposes a limit of 250 business-initiated chats per business phone number during each rolling 24-hour period, applicable to those awaiting connected status and approved display names.

What is the 24-hour rule on WhatsApp?

The 24-hour rule allows businesses to respond to messages from customers for free within a 24-hour window. This window resets with every message sent by a customer, and the 24-hour timeframe for billing starts with the business’s first message sent and concludes precisely 24 hours later.