Executive summary

Embracing the digital age, the insurance sector is witnessing a transformative shift with the integration of chatbots. This comprehensive guide explores the intricacies of insurance chatbots, illustrating their pivotal role in modernizing customer interactions. From automating claims processing to offering personalized policy advice, this article unpacks the multifaceted benefits and practical applications of chatbots in insurance. This article is an essential read for insurance professionals seeking to leverage the latest digital tools to enhance customer engagement and operational efficiency.

Chatbots, once a novelty in customer service, are now pivotal players in the insurance industry. They’re breaking down complex jargon and offering tailor-made solutions, all through a simple chat interface.

Chatbots have become more than digital assistants; they are now trusted advisors, helping customers navigate the myriad of insurance options with ease and precision. They represent a shift from one-size-fits-all solutions to customized, interactive experiences, aligning perfectly with the unique demands of the insurance sector. In this article, we’ll explore how chatbots are bringing a new level of efficiency to the insurance industry.

Related must-reads:

- Customer service chatbots: Benefits and examples [2023]

- How to create a chatbot – Best practices to follow in 2023

- 30 Chatbot applications from six key industries

- Enterprise Chatbot – A Guide for Enterprises [2023]

- Benefits of AI Chatbots for Businesses and Customers

The global rise of chatbot popularity: A 2024 perspective

As we inch closer to 2024, the global popularity of chatbots is soaring. Chatbots have transcended from being a mere technological novelty to becoming a cornerstone in customer interaction strategies worldwide. Their adoption is a testament to the shifting paradigms in consumer expectations and business communication.

- Surging market valuation: The global chatbot market, valued at $4.7 billion in 2022, is on a meteoric rise. Projections suggest a growth spurt to $15.5 billion by 2028, marking a robust Compound Annual Growth Rate (CAGR) of 23.3%.

- Consumer satisfaction and preference: An overwhelming 80% of consumers report satisfaction with chatbot interactions. The efficiency and accuracy of chatbots in delivering quick answers have led to a 74% preference for chatbots over human agents for routine inquiries.

- High awareness and adoption rates: Chatbots enjoy a staggering 96% awareness rate among consumers. Leading corporations like LinkedIn, Starbucks, and British Airways are not just using chatbots; they are setting benchmarks in automated customer service.

The trajectory of chatbot technology is evident. As we approach 2024, the integration of chatbots into business models is becoming less of an option and more of a necessity. The data speaks for itself – chatbots are shaping the future of customer interaction.

In the insurance industry, where personalization and quick service are key, chatbots represent a golden opportunity. They promise not only to elevate customer experience but also to streamline operations, making them an indispensable tool for insurance companies. Data source

What is an insurance chatbot?

An insurance chatbot is a specialized virtual assistant designed to streamline the interaction between insurance providers and their customers. These digital assistants are transforming the insurance services landscape by offering efficient, personalized, and 24/7 communication solutions.

Rule-based insurance chatbots

Rule-based chatbots in insurance operate on predefined rules and workflows. These chatbots are programmed to recognize specific commands or queries and respond based on set scenarios. They excel in handling routine tasks such as answering FAQs, guiding customers through policy details, or initiating claims processes. Their strength lies in their predictability and consistency, ensuring reliable responses to common customer inquiries.

- Efficient for common queries: Rule-based chatbots excel in addressing common, straightforward questions where responses are predictable and uniform.

- Quick implementation: Rule-based chatbots are relatively easy to set up, as they require the configuration of specific rules and responses, streamlining the deployment process.

- Limited flexibility: While efficient, these chatbots lack the ability to handle queries that fall outside their programmed rules. They can’t improvise or understand nuanced customer needs beyond their set programming.

AI-driven insurance chatbots

AI-driven chatbots represent a significant leap in chatbot technology. Unlike their rule-based counterparts, they leverage Artificial Intelligence (AI) to understand and respond to a broader range of customer interactions. These chatbots are trained to comprehend the nuances of human conversation, including context, intent, and even sentiment.

- Understanding complex queries: AI chatbots can process and respond to diverse and complex queries, going beyond predefined scenarios. They offer a more dynamic and engaging interaction, closely resembling human conversation.

- Continuous learning and improvement: One of the most striking features of AI-driven chatbots is their ability to learn from each interaction, continuously refining their understanding and responses. This adaptability ensures that they become more efficient and relevant over time.

- Training and evolution: Implementing AI chatbots involves an initial training phase where the bot learns from various data inputs, including common queries and industry-specific jargon. Over time, these chatbots evolve, offering more accurate and personalized assistance to customers.

Insurance chatbots, be it rule-based or AI-driven, are playing a crucial role in modernizing the insurance sector. They offer a blend of efficiency, accuracy, and personalized service, revolutionizing how insurance companies interact with their clients. As the industry continues to embrace digital transformation, these chatbots are becoming indispensable tools, paving the way for a more connected and customer-centric insurance landscape.

Top 8 Benefits of insurance chatbots

The integration of chatbots in the insurance industry is a strategic advancement that brings a host of benefits to both insurance companies and their customers.

Let’s explore how these digital assistants are revolutionizing the insurance sector.

- 24/7 customer support: Always available, always responsive

- Easy claims processing and settlement: Simplifying complexity

- Enhanced security: Safeguarding sensitive information

- Multilingual support: Breaking language barriers

- Cost reduction: A financial game-changer

- Boosting agent productivity: Focus on what matters

- Engaged and satisfied customers

- Effective lead generation

1. 24/7 customer support: Always available, always responsive

One of the most significant advantages of insurance chatbots is their ability to offer uninterrupted customer support. Unlike human agents, chatbots don’t require breaks or sleep, ensuring customers receive immediate assistance anytime, anywhere. This round-the-clock availability enhances customer satisfaction by providing a reliable communication channel, especially for urgent queries outside regular business hours.

2. Easy claims processing and settlement: Simplifying complexity

Claims processing is traditionally a complex and time-consuming aspect of insurance. Chatbots significantly simplify this process by guiding customers through claim filing, providing status updates, and answering related queries. Besides speeding up the settlement process, this automation also reduces errors, making the experience smoother for customers and more efficient for the company.

3. Enhanced security: Safeguarding sensitive information

In an industry where confidentiality is paramount, chatbots offer an added layer of security. Advanced chatbots, especially those powered by AI, are equipped to handle sensitive customer data securely, ensuring compliance with data protection regulations. By automating data processing tasks, chatbots minimize human intervention, reducing the risk of data breaches.

4. Multilingual support: Breaking language barriers

The ability to communicate in multiple languages is another standout feature of modern insurance chatbots. This multilingual capability allows insurance companies to cater to a diverse customer base, breaking down language barriers and expanding their market reach. For example, AI chatbots powered by Yellow.ai can interact in over 135 languages and dialects via text and voice channels. It also eliminates the need for multilingual staff, further reducing operational costs.

5. Cost reduction: A financial game-changer

Deploying chatbots can lead to significant cost savings. By automating routine inquiries and tasks, chatbots free up human agents to focus on more complex issues, optimizing resource allocation. This efficiency translates into reduced operational costs, with some estimates suggesting chatbots can save businesses up to 30% on customer support expenses.

6. Boosting agent productivity: Focus on what matters

Chatbots take over mundane, repetitive tasks, allowing human agents to concentrate on solving more intricate problems. This delegation increases overall productivity, as agents can dedicate more time and resources to tasks that require human expertise and empathy, enhancing the quality of service.

7. Engaged and satisfied customers

Chatbots contribute to higher customer engagement by providing prompt responses. Integration with CRM systems equips chatbots with detailed customer insights, enabling them to offer personalized assistance, thereby enhancing the overall customer experience.

8. Effective lead generation

Insurance chatbots are excellent tools for generating leads without imposing pressure on potential customers. By incorporating contact forms and engaging in informative conversations, chatbots can effectively capture leads and initiate the customer journey.

Related read: Lead generation chatbots: Top 5 benefits in 2023

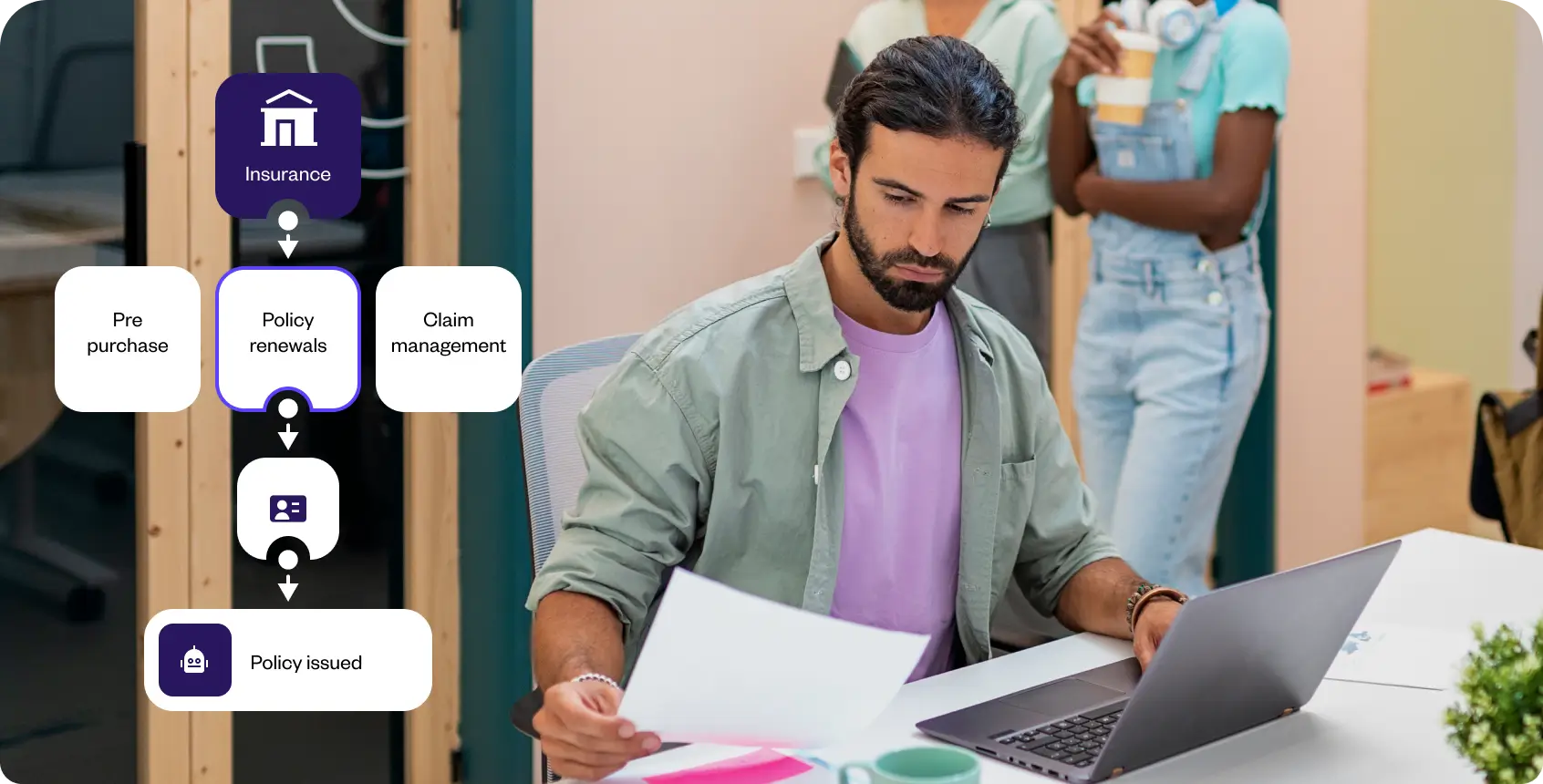

7 Use cases of insurance chatbots

The advent of chatbots in the insurance industry is not just a minor enhancement but a significant revolution. These sophisticated digital assistants, particularly those developed by platforms like Yellow.ai, are redefining insurance operations.

Let’s explore seven key use cases that demonstrate the versatility and impact of insurance chatbots.

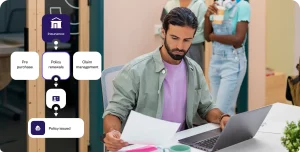

- Assisting in choosing insurance plans

- Simplifying insurance plans

- Streamlining Insurance claims processing

- Providing detailed policy information

- Enhancing application collection and customer qualification

- Assisting with insurance payments

- Gathering customer feedback

Related read: Automation in insurance: Examples, benefits and more

Use case #1. Assisting in choosing insurance plans

Insurance chatbots are revolutionizing how customers select insurance plans. By asking targeted questions, these chatbots can evaluate customer lifestyles, needs, and preferences, guiding them to the most suitable options. This interactive approach simplifies decision-making for customers, offering personalized recommendations akin to a knowledgeable advisor. For instance, Yellow.ai’s platform can power chatbots to dynamically adjust queries based on customer responses, ensuring a tailored advisory experience.

Example: A customer looking for health insurance might be asked about their medical history, lifestyle habits, and family health background. Based on this data, the chatbot can suggest a plan that offers the best coverage for pre-existing conditions or wellness programs that suit their lifestyle.

Use case #2. Simplifying insurance plans

Complex insurance terminologies can often be a barrier. Insurance chatbots excel in breaking down these complexities into simple, understandable language. They can outline the nuances of various plans, helping customers make informed decisions without overwhelming them with jargon. This transparency builds trust and aids in customer education, making insurance more accessible to everyone.

Example: Consider a customer confused about the terms ‘deductible’ and ‘premium.’ A chatbot can provide easy-to-understand definitions and examples, making these concepts more accessible. It can help customers make better-informed decisions about their insurance purchases.

Use case #3. Streamlining insurance claims processing

Chatbots significantly expedite claims processing, a traditionally slow and bureaucratic process. They can instantly collect necessary information, guide customers through the submission steps, and provide real-time updates on claim status. This efficiency not only enhances customer satisfaction but also reduces administrative burdens on the insurance company.

Example: In a car insurance scenario, a customer can upload photos of vehicle damage directly to the chatbot, which then initiates and tracks the claim process, making it swift and hassle-free.

Use case #4. Providing detailed insurance policy information

Customers often have specific questions about policy coverage, exceptions, and terms. Insurance chatbots can offer detailed explanations and instant answers to these queries. By integrating with databases and policy information, chatbots can provide accurate, up-to-date information, ensuring customers are well-informed about their policies.

For example, customers who inquire about travel insurance coverage for adventure sports can receive detailed information on what activities are covered and the associated conditions.

Use case #5. Enhancing application collection and customer qualification

Insurance chatbots are potent tools for lead generation. They can engage website visitors, collect essential information, and even pre-qualify leads by asking pertinent questions. This process not only captures potential customers’ details but also gauges their interest level and insurance needs, funneling quality leads to the sales team.

Example: A visitor on an insurance website interested in vehicle insurance can interact with a chatbot that collects information about the vehicle type, usage, and the customer’s driving history to suggest the best insurance options.

Use case #6. Assisting with insurance payments

Chatbots can facilitate insurance payment processes, from providing reminders to assisting customers with transaction queries. By handling payment-related queries, chatbots reduce the workload on human agents and streamline financial transactions, enhancing overall operational efficiency.

Example: A chatbot can notify a customer of an upcoming premium payment, offer different payment options, and guide them through the payment process.

Use case #7. Gathering customer feedback

Collecting feedback is crucial for any business, and chatbots can make this process seamless. They can solicit feedback on insurance plans and customer service experiences, either during or after the interaction. This immediate feedback loop allows insurance companies to continuously improve their offerings and customer service strategies, ensuring they meet evolving customer needs.

Example: After a policy renewal, a chatbot can ask the customer to rate their experience and provide suggestions for service enhancement. It can help the insurance company develop a stronger and more personalized bond with the consumer.

Examples of insurance chatbots: Pioneering digital transformation

The insurance industry is experiencing a digital renaissance, with chatbots at the forefront of this transformation. These intelligent assistants are not just enhancing customer experience but also optimizing operational efficiencies. Let’s explore how leading insurance companies are using chatbots and how insurance chatbots powered by platforms like Yellow.ai have made a significant impact.

Example #1. Revolutionizing customer interaction with multilingual voice bots

A leading insurer faced the challenge of maintaining customer outreach during the pandemic. Implementing Yellow.ai’s multilingual voice bot, they revolutionized customer service by offering policy verification, payment management, and personalized reminders in multiple languages.

Impact: The adoption of this technology led to an 80% reduction in operational costs and a 5X scaling in capacity, showcasing the profound efficiency of AI-driven solutions in customer engagement.

Example #2. Automating customer service for streamlined operations

Insurance chatbots are redefining customer service by automating responses to common queries. This shift allows human agents to focus on more complex issues, enhancing overall productivity and customer satisfaction.

A chatbot could assist in policy comparisons and claims processes and provide immediate responses to frequently asked questions, significantly reducing response times and operational costs.

Example #3. Transforming lead generation and conversion

Chatbots are proving to be invaluable in capturing potential customer information and assisting in the sales funnel. By interacting with visitors and pre-qualifying leads, they provide the sales team with high-quality prospects.

Yellow.ai’s chatbots can be programmed to engage users, assess their insurance needs, and guide them towards appropriate insurance plans, boosting conversion rates.

Example #4. Simplifying claims processing with AI

Claim processing can be a tedious task for both customers and insurers. Chatbots simplify this by providing a direct platform for claim filing and tracking, offering a more efficient and user-friendly approach.

Customers can submit claim details and necessary documentation directly to the chatbot, which then processes the information and updates the claim status, thereby expediting the settlement process.

Example #5. Personalized marketing and policy management

Utilizing data analytics, chatbots offer personalized insurance products and services to customers. They help manage policies effectively by providing instant access to policy details and facilitating renewals or updates.

An AI chatbot can analyze customer interaction history to suggest tailor-made insurance plans or additional coverage options, enhancing the customer journey.

Example #6. Operational cost reduction and enhanced data analytics

By automating routine tasks, chatbots reduce the need for extensive human intervention, thereby cutting operating costs. They collect valuable data during interactions, aiding in the development of customer-centric products and services.

An insurance chatbot can track customer preferences and feedback, providing the company with insights for future product development and marketing strategies.

Example #7. Advanced security and compliance

In an industry where data security is paramount, AI chatbots ensure the secure handling of sensitive customer information, adhering to strict compliance and privacy standards.

Yellow.ai’s chatbots are designed to process and store customer data securely, minimizing the risk of data breaches and ensuring regulatory compliance.

How Yellow.ai can help build AI insurance chatbots?

Yellow.ai stands out as a dynamic platform in the realm of conversational AI, offering bespoke chatbot solutions tailored for the insurance industry. Their cutting-edge technology enables insurers to:

- Deploy multilingual chatbots: Catering to a global audience with the ability to interact in over 135 languages.

- Seamless system integration: Effortlessly integrates with existing insurance systems for a unified customer experience.

- Dynamic voice AI agents: Facilitates natural, conversational interactions, enhancing customer engagement and satisfaction.

- Power of Generative AI & specialized LLMs: Employs advanced generative AI capabilities and specialized LLMs for nuanced understanding and incredibly human-like response generation at scale.

Insurance companies looking to embrace digital transformation and elevate their customer service can significantly benefit from Yellow.ai’s comprehensive solutions. Interested in exploring how Yellow.ai can revolutionize your insurance services?

The final word on insurance chatbots

Chatbots have begun a new chapter in insurance, offering unparalleled efficiency, personalized customer service, and operational agility. Their ability to adapt, learn, and provide tailored solutions is transforming the insurance landscape, making it more accessible, customer-friendly, and efficient. As we move forward, the continuous evolution of chatbot technology promises to enhance the insurance experience further, paving the way for an even more connected and customer-centric future.

Insurance chatbot – Frequently asked questions (FAQs)

What is the future of chatbots in insurance?

The future of chatbots in insurance looks exceptionally bright. With advancements in AI and machine learning, chatbots are set to become more intelligent, personalized, and efficient. They will continue to improve in understanding customer needs, offering customized advice, and handling complex transactions. The integration of chatbots is expected to grow, making them an integral part of the insurance landscape, driven by their ability to enhance customer experience and operational efficiency.

What are the benefits of an insurance chatbot?

Insurance chatbots offer numerous benefits, including 24/7 customer support, streamlined claims processing, enhanced data security, multilingual communication, cost reduction, increased agent productivity, improved customer engagement, and efficient lead generation. They simplify complex processes, provide quick and accurate responses, and significantly improve the overall customer service experience in the insurance sector. And with generative AI in the picture now, these conversations are incredibly human-like.

How does AI help in the insurance industry?

As AI chatbots and generative AI systems in the insurance industry, we streamline operations by providing precise risk assessments and personalized policy recommendations. The advanced data analytics capabilities aids in fraud detection and automates claims processing, leading to quicker, more accurate resolutions. Through direct customer interactions, we improve the customer experience while gathering insights for product development and targeted marketing. This ensures a responsive, efficient, and customer-centric approach in the ever-evolving insurance sector.

How many insurance companies use chatbots?

While exact numbers vary, a growing number of insurance companies globally are adopting chatbots. The need for efficient customer service and operational agility drives this trend. Chatbots are increasingly being used for a variety of purposes, from customer queries and claims processing to policy recommendations and lead generation, signaling a widespread adoption in the industry.

What are the benefits of chatbots in health insurance?

In health insurance, chatbots offer benefits such as personalized policy guidance, easy access to health plan information, quick claims processing, and proactive health tips. They can answer health-related queries, remind customers about policy renewals or medical check-ups, and provide a streamlined experience for managing health insurance needs. Chatbots in health insurance improve customer engagement and make health insurance management more user-friendly.