Customer experience, since its origin in 1994 by Lewis “Lou” Carbone, also known as the father of customer experience, has been the topmost priority for businesses. In this age of information, businesses see customer experience as a differentiating factor that can gain them a competitive advantage.

Present-day companies have penetrated into the daily lives of customers using WhatsApp chatbots for delivering excellent customer experience.

WhatsApp began to get monetized by Facebook by developing WhatsApp Business app for small businesses and WhatsApp business API for medium and large enterprises. This experiment of using chatbots on the biggest messaging platform proved to be a great success for businesses.

WhatsApp chatbots improve customer experience by helping businesses engage with their customers like never before.

Businesses can be available round the clock, interact with them in multiple languages and send update notifications regarding their orders and requests.

In this article, we will look at the importance of WhatsApp chatbots and the reasons why businesses are opting for WhatsApp chatbots to improve customer experience.

Related must read: Customer experience vs. customer service

These reasons will explain why and how you can leverage WhatsApp chatbots in your business and improve customer experience.

Related must-reads:

- AI chatbots – The complete guide to chatbot solution

- 9 Best chatbot examples for businesses by industry [2024]

- Future of Chatbots: Key Trends to Watch in 2023!

- Enterprise Chatbot – A Guide for Enterprises [2023]

- Benefits of AI Chatbots for Businesses and Customers

Importance of WhatsApp chatbots in customer experience

WhatsApp is a trusted and loved messaging platform. Due to its user-friendly features and simplicity, it has become an integral part of customers’ lives. Now with over 95% open rate, it is also a favorite business communication tool.

In order to stay ahead of the competition, your business needs to adapt WhatsApp chatbots for customer experience. Listed below are some of the important and beneficial features that only WhatsApp chatbots can provide for your business.

1. Popularity among the target audience

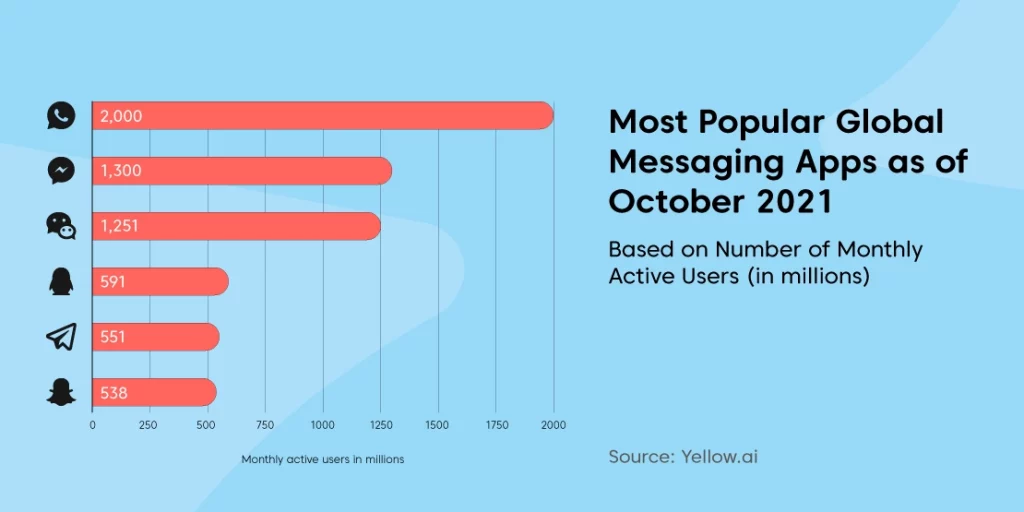

With a user base of over 2 billion people, WhatsApp is the biggest and most popular messenger platform. Businesses in every industry can find their target audience engaging with them over WhatsApp.

Businesses already using WhatsApp Business API are far above their competitors in terms of customer engagement and customer satisfaction. This is because they are present where their customers are.

2. Secure and GDPR compliant platform

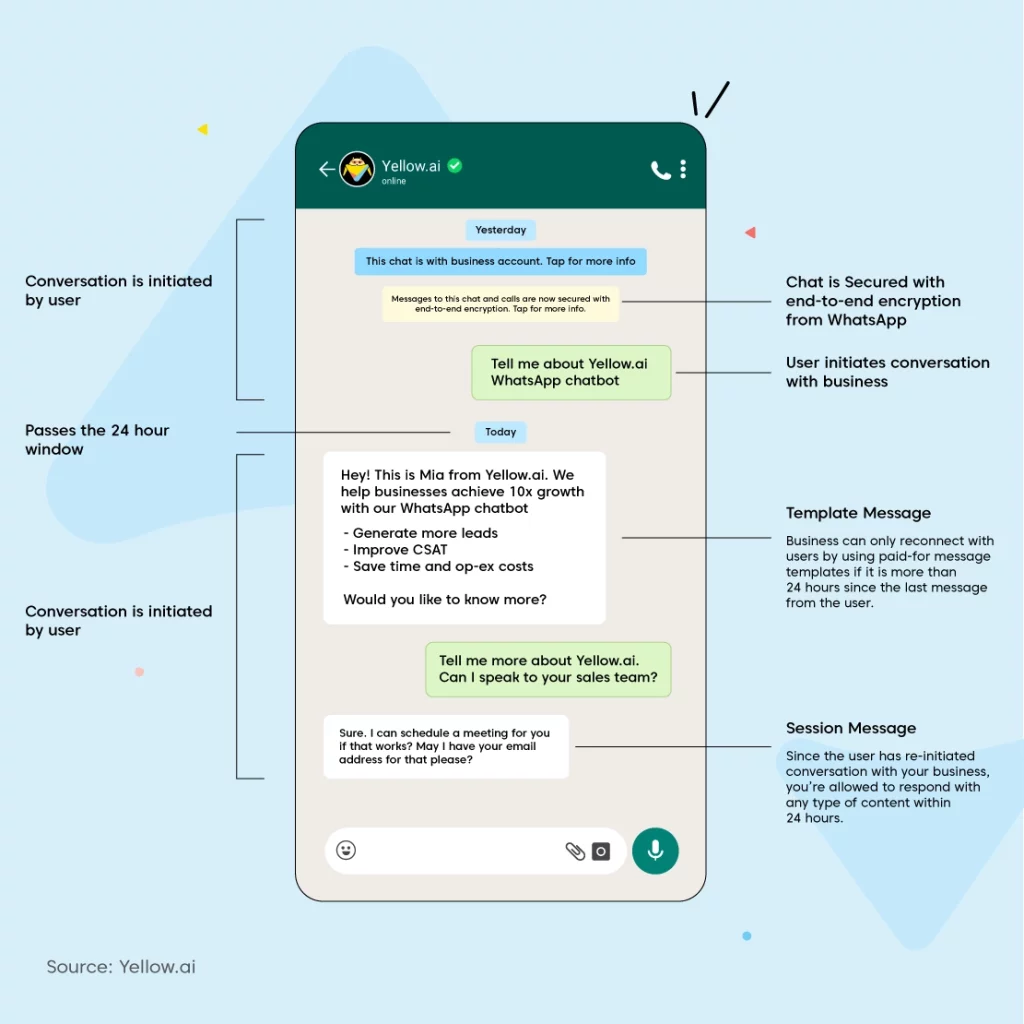

Another important feature of WhatsApp chatbots is their security. All the messages on WhatsApp are encrypted and do not invite any fraudulent activity. This is one of the biggest reasons for the popularity of the channel.

In addition, WhatsApp is GDPR compliant and does not allow businesses to send messages until and unless the user has opted-in or sends a message to the business.

3. Excellent features for professional use

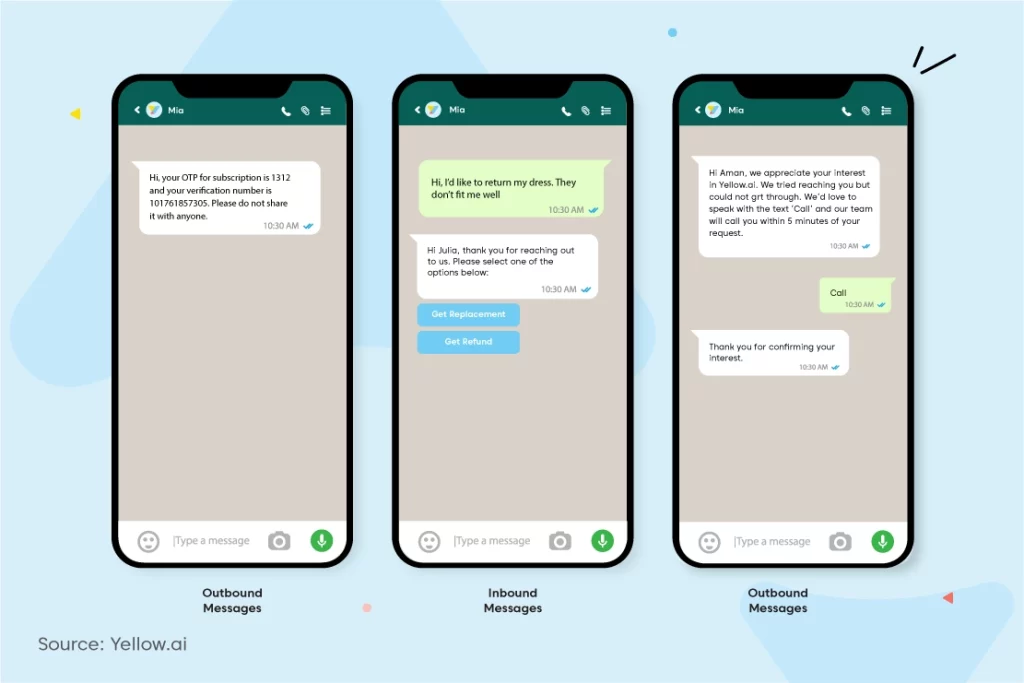

WhatsApp Business API provides amazing features for businesses such as message templates and updates notifications. A business can set conditions for the messages to get triggered and sent automatically based on the working hours, heavy traffic or agent unavailability.

Messages can be multi-media containing images, documents, videos or even the location of your business. However, businesses cannot send promotional or alluring messages to their customers.

4. Economical tool for improving customer experience

WhatsApp has assigned businesses-providers to offer WhatsApp Business API to medium and large businesses. These businesses offer a WhatsApp chatbot and a CRM to manage conversations with multiple logins.

The prices provided by each business partner are different but it is very economical and a safe bet to place. It helps businesses save a lot of time, money and human resources by automating mundane and repetitive conversations.

5. Easy to implement and use

Building a WhatsApp chatbot needs no previous coding or conversational AI experience. WhatsApp provides the API implemented in a chatbot by the business partners such as Yellow.ai.

Keeping in mind the target audience, WhatsApp CRM is very user-friendly and easy to use. Any of your team members can easily interact with the customers using the WhatsApp chatbot.

10 Ways to use WhatsApp chatbots for customer experience

We have seen the multiple WhatsApp features that are beneficial for businesses as well as customers. Moving forward let us take a deeper dive into how to use and leverage the benefits of WhatsApp chatbots for providing an excellent customer experience.

1. Providing instant answers to FAQs

With WhatsApp chatbots, businesses can automate instant responses to frequently asked questions. For example, if you are a healthcare facility, customers might reach out to you about your timings, location, virtual/video conferencing with the doctors, appointments and a lot more.

Once you automate answers to these FAQs, you will not need a human agent continuously receiving calls for appointments and general inquiries.

2. Engaging with customers 24×7

Even if your business hours are over and your employees are away, you can still engage with your customers using WhatsApp chatbots.

WhatsApp can be used to send pre-approved message templates and interactive list messages automatically. Suppose you set a condition to send an OOO or away message between 9 pm and 7 am. Any customer sending a message between these hours will receive a message informing them about the business hours and the next available time.

3. Delivering a live chat experience

WhatsApp chatbots come with a multi-agent CRM any agent from the whole team can engage with customers at a given time.

This feature helps businesses provide a no-wait live chat experience with any agents available. The responsibility of providing instant responses over WhatsApp can be shared by the complete customer support team.

4. Running WhatsApp ads

WhatsApp ads are a proven result-driven marketing tool using which companies can acquire more qualified leads without making many efforts. A number of brands today use WhatsApp ads to attract customers to their WhatsApp landing page.

Using WhatsApp ads can help businesses capture qualified leads efficiently in the era of the Metaverse.

5. Automating using message templates

The WhatsApp message template is a great feature that can help you in keeping your customers engaged with the brand. You can send updates regarding their order updates, payment reminders, alert messages in case of any unusual activity and many more.

This feature comes only with WhatsApp Business API and if used properly by businesses, message templates give a brilliant opportunity to improve your brand recall value and customer satisfaction.

6. Attending to customers through personalization

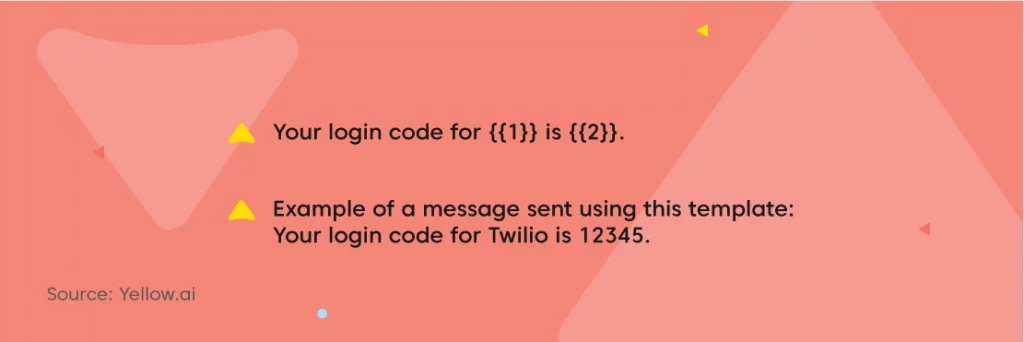

WhatsApp Business API lets you personalize the messages by using the information present in the database or a .csv file. You can use variables like {{column number}}, and this will replace with the value saved in the backend.

Using this feature, your brand will be able to personalize the messages sent to the customers based on their personal details, order details and other preferences.

7. Recovering abandoned carts

Order placement can be easily completed using WhatsApp chatbots. A customer can browse through your products and menu, look at the images, read product descriptions and place orders.

Even in the case of abandoned carts, WhatsApp chatbots can come in handy and remind customers about the products waiting for them and improve customer experience.

8. Providing after-sales support

Customer experience is about building and maintaining a healthy relationship with customers throughout their journey with the brand and even beyond. If a business aims to provide a good customer experience, it must be ready with an after-sales support plan.

WhatsApp chatbots can be a great resource for after-sales support as customers find it very easy to send a WhatsApp message related to their query instead of sending an email and waiting for 24-48 hours to get it resolved.

9. Gathering feedback and reviews

Reviews and ratings play a major role in building trust in the heart of your customers. Collecting feedback and reviews is a tricky task, especially with a positive customer experience because for customers adding feedback is another task that can be simply ignored.

Customers are continuously present on WhatsApp and can share their feedback with the business on the channel. They will not need to open any other apps or forms, rather just write a simple message on their favorite messaging platform.

10. Sharing help guides and other relevant information

WhatsApp can be used to share multimedia content, links to relevant information and other documents. Businesses can use the platform to share the content and help customers by imparting knowledge about their products and services.

Using WhatsApp chatbots for improving customer experience can prove to be a wise decision for businesses. Once you start using the platform for the above-mentioned use cases, businesses can observe a continuous improvement in customer satisfaction and customer retention.

Conclusion

By the end of this blog post, we hope you have a clear understanding of how your business can leverage WhatsApp chatbots for customer experience and what returns can you expect from the investment in the channel.

If you need to know more about WhatsApp Business API or you are ready to use the chatbot for automating your conversational processes simply request a demo with us and understand the possibilities of improving customer experience.